Governance is the system through which an organisation makes and implements decisions to pursue its goals; the implemented choices and activities can make a significant contribution to sustainable development.

Governance constitutes our institutional framework and, in order to effectively adopt strategies that respect and enhance the other two factors (Environmental and Social), it must also be guided by ethical principles in line with ESG factors.

These guidelines are particularly reflected in the Code of Ethics, a document that sets out commitments and responsibilities in conducting the Bank’s business and activities, while also defining the set of values, as well as the conduct, that must be adopted by the governing bodies, employees and, in general, by all those who work with the Bank.

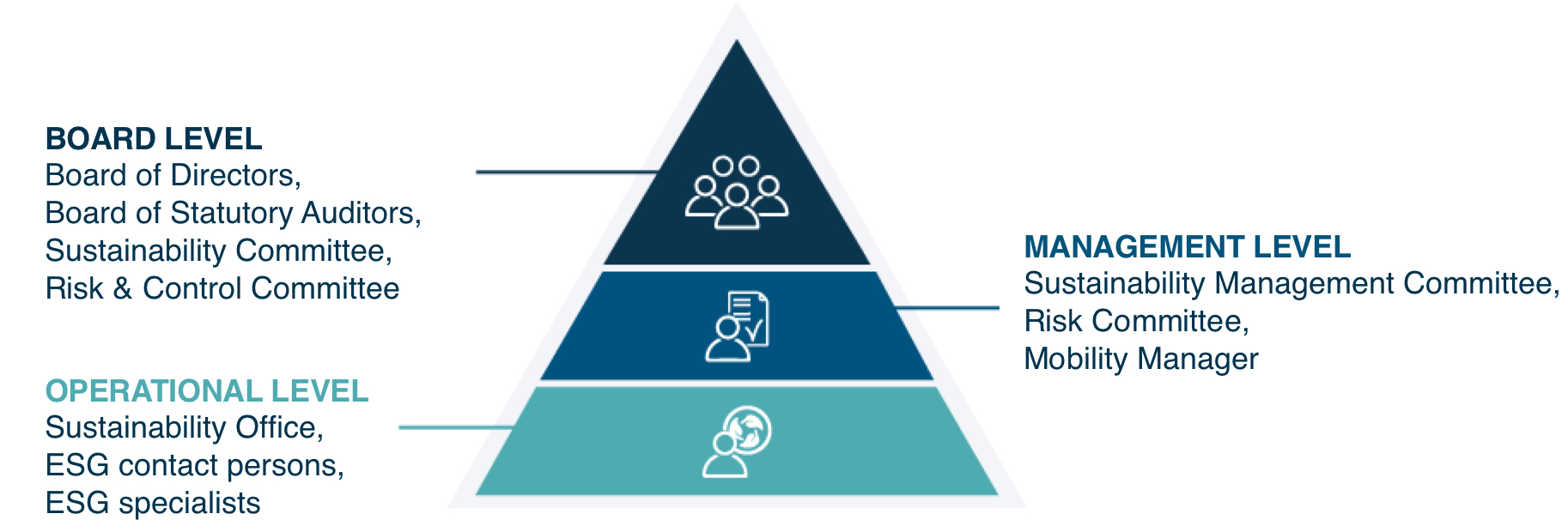

ESG Governance

Board level: Board of Directors, Board of Statutory Auditors, Sustainability Committee, Risk & Control Committee. Management Level: Sustainability Management Committee, Risk Committee, Mobility Manager. Operation Level: Sustainability Office, ESG contact person

Defines Group-wide guidelines, targets and strategies, approves the NFR and supervises the handling of ESG topics. Coordinates Sustainability-activities, as well as supporting and regularly reporting to the BoD. Oversees regulatory developments and manages the implementation of the ESG initiatives.

Key numbers

Insights

-

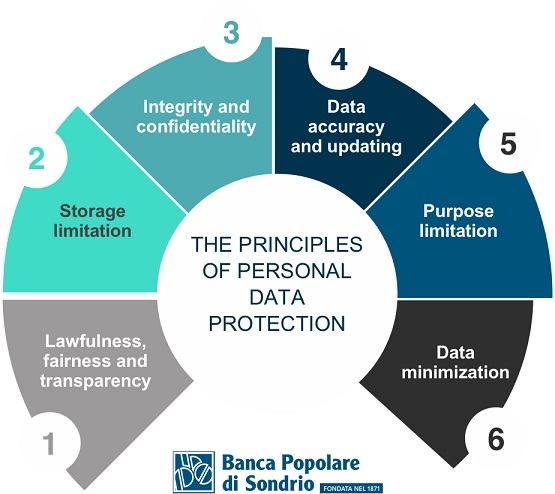

Data Protection

Protecting the confidentiality and security of information on individuals is a key factor in our activities, which is why we are committed to ensuring that the collection and further processing of personal data is carried out in compliance with applicable legislation.

Lawfulness, fairness and transparency. Storage limtiation. Integrity and confideantiality. Data accuracy and updating. Purpose limitation. Data minimization

-

ESG control system

- ESG audit controls to assess the level of preparedness for managing climate and environmental risks. The possible effects on internal policies and procedures, as well as on the internal control system, were also analysed.

- Verification of the Bank’s implementation of ESG regulatory framework with the aim of assessing the adequacy of the organisational procedures and systems for the prevention of non-compliance risks in the field of sustainability.

-

Cyber security

Integrity, confidentiality and availability of data are protected by an Information Security Management System which has been certified ISO/IEC 27001:2013 since 2006 and is constantly evolving. All employees are engaged in this area thanks to the internal IT Regulation, which promotes the secure use of digital resources. In an increasingly connected world, cybercriminals are targeting end users in particular: this is precisely why the Bank invests in the dissemination of good security practices, through the adoption of tools such as:

- the ten rules for online safety;

- the Navigosereno service, which provides practical advice and periodic checks on PCs, smartphones and tablets.

For further details: popso.it/sicurezza-online (in Italian).

-

Governance of Artificial Intelligence

Artificial Intelligence is revolutionising the way we do business, boosting efficiency through smart data analysis. With the introduction of the EU AI Act (Regulation (EU) 2024/1689) innovation develops in compliance with fundamental rights. We have launched concrete projects involving AI, such as Predittive, OutlAIer, Òmìnà and EWM, already operational at our headquarters and branches. FrodIA will be launched soon to combat bank transfer fraud.

We are currently also in the process of testing PopsoGPT mini, a generative AI assistant that helps employees find information using natural language: an innovative tool that has already received positive feedback and that will soon be extended to other business areas.

-

Digital Accessibility

We are committed to making technology accessible to all, with particular attention to the needs of people with disabilities. The new www.popso.it website has been online since 23 December 2024, and it is designed to ensure browsing using screen readers, voice synthesisers and full usability from any device.

Our commitment to inclusion also translates into a complete range of digital services: bank transfers (including instant), Braille statements, top-ups, F24, IMU, and TARI tax payments, as well as pagoPA payments in favour of the public administration, which are also available on SCRIGNOPagoFacile and can be used by everyone, even non-customers.

Digital services are available in Italian, English, French and German, and the SCRIGNOapp and SCRIGNOIdentiTel apps include advanced, multilingual features.