The ESG Credit Policy identifies the approach and general principles of Banca Popolare di Sondrio in the integration of environmental, social and governance factors into the loan origination and monitoring process.

The 2025-2027 Business Plan «Our way forward» continues with the integration of Sustainability into our business model, in line with the commitment to development and value creation for our territories and, in general, all stakeholders.

In October 2024, the Bank updated the ESG Credit Policy according to the Sustainability strategy and in the light of memebership to Net-Zero Banking Alliance.

Integration of ESG factors into the credit process

The Bank has defined the ESG Framework for managing the impacts arising from ESG factors, envisaging specific actions aimed at managing all stages of the credit process.

ESG strategy

Credit process integration

ESG

metrics

Corporate culture

ESG strategy

Definition of a ESG strategy with mitigation initiatives applied to credit assets and supporting the transition towards a low-fossil-fuel economy, less dependent on non-renewable natural resources and able to reduce the negative impact on the environment.

Credit process integration

Implementation of Counterparty ESG score, available for all the counterparties according to the potential financial impacts due to the exposure to transition, physical and Esg risks. In addition, an ESG Due Diligence for specif customer segments is provided and intensified controls for ESG-sensitive sectors too.

ESG metrics

Understanding of the operational context peculiarities and identification of lending and sectoral strategies and/or operational specific criteria. Development of green loans, S-linked loans and taxonomy alignment evaluation.

Corporate culture

Development and promotion of a corporate culture supporting the protection and prevention of ESG risks in line with the ethical and integrity principles which are the foundation of Bank’s behavior and acting.

The three-tiered framework

With the aim of enabling the ESG assessment of counterparties, the Bank has adopted a three-tiered framework that considers, on the one hand, the ethical and integrity principles that form its way of operating and acting and, on the other hand, the peculiarities of the context in which the counterparties operate.

-

1 - General criteria

The Group excludes financing activities towards counterparties regarding which, during the initial credit evaluation phase or during a periodic re-evaluation, emerge one of the following circumstances:

- sanctions related to significant violations and abuses of human rights;

- sanctions related to cyber-attacks towards the European Union or Member States;

- specific restrictive measures designed to combat terrorism;

- operations in the area of controversial weapons;

- violation of fundamental labor rights, child and forced labor standards;

- activities/operations conducted at the expense of protected sites (UNESCO World Heritage Sites, for instance).

The Group adopts Positive screening criteria towards counterparties that present:

- official transition plans or commitments to GHG emission;

- a sustainability report;

- specific investment projects that demonstrate the alignment with the EU Taxonomy;

- in sustainability reporting, balance sheet KPIs aligned with the EU Taxonomy.

2 - Sectoral criteria

3 - Operation criteria

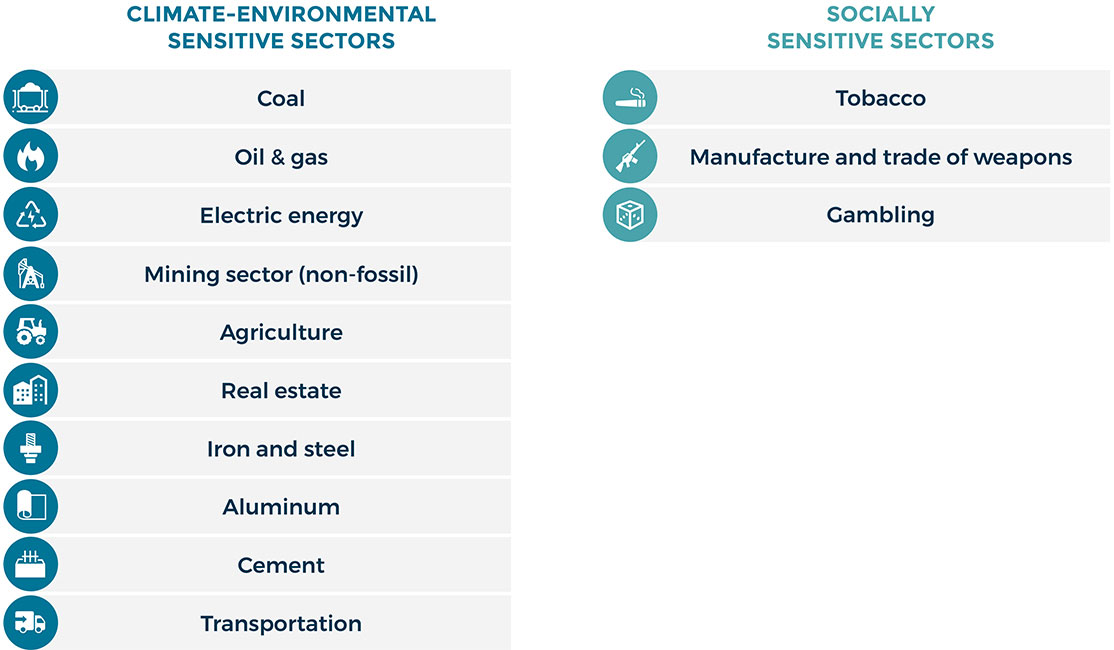

Sectorial and Operational Criteria identify Positive Screening, Build out or Negative Screening modalities according to, respectively, industry and counterpart specifics the former and operation specifics the latter. These are the sector we closely monitor:

The ESG risk assessment methodologies and the related tools comply with the so-called “double materiality” principle, according to which the business value may be simultaneously subject to the negative influence of ESG factors and have a negative impact on ESG factors.

As with all the key processes characterising its business model, Banca Popolare di Sondrio has defined an ESG risk management framework, aimed at taking into consideration – in credit granting process- evaluations of counterpart exposure to climate-related and environmental risks, through proprietary scoring systems.

For more information on climate-related and environmental risks controls, please refer to Environment, Initiatives, Climate and environmental Risks.

The Bank is active in developing and offering financial products with positive environmental and social impacts.

The full range of ESG products is available on Banca Popolare di Sondrio website

| Attachment | Size |

|---|---|

| ESG Credit Policy | 685.75 KB |