Banca Popolare di Sondrio is called on to take specific actions to help fight climate change and protect the environment, as essential preconditions for long-term sustainable development.

In this perspective, the Bank has adopted a climate strategy and has joined the Net-Zero Banking Alliance (NZBA), as a climate accelerator for the identification of targets useful for reducing the financed emissions.

Here the press Release of the membership.

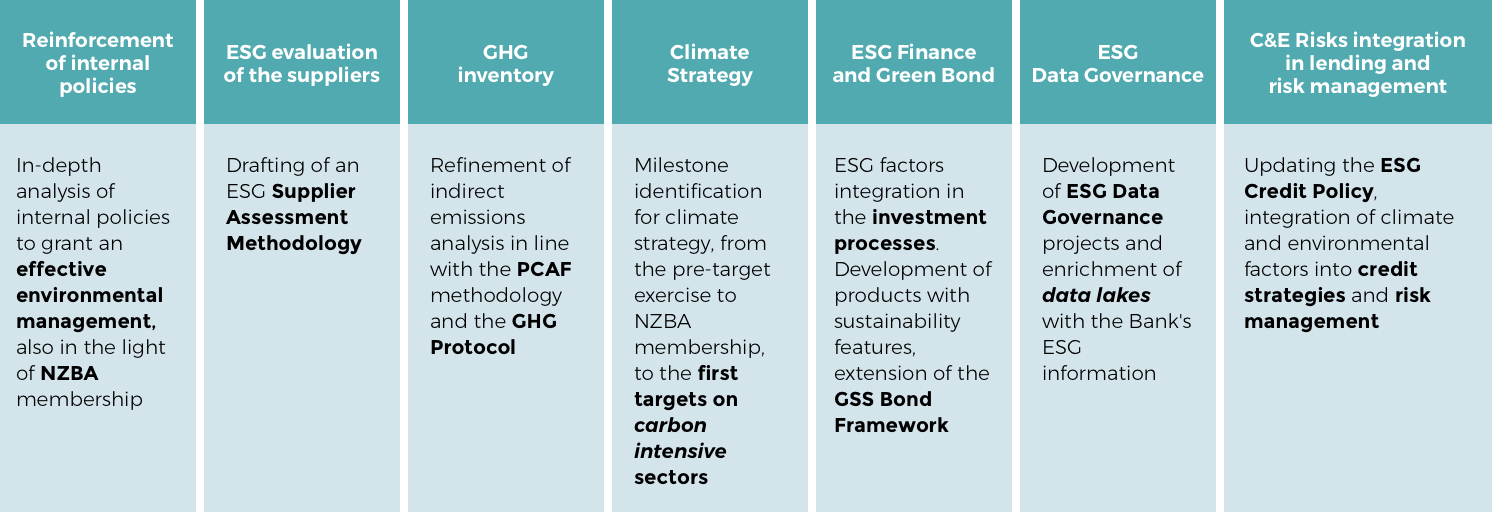

Here, instead, the press release about the first set of targets for decarbonization, anticipated in the graphic below.

In line with the Environmental Policy, we have set a series of climate-environmental objectives to contribute to the green transition, developing coherent and increasingly ambitious actions.

The Environmental Policy identifies the Bank's approach to managing environmental issues, outlining the measures and actions it intends to take over time. The Bank considers environmental impacts as a relevant area and therefore proposes to:

- reduce the environmental impacts of resource consumption, waste generation and other direct impact activities;

- manage the effects of activities with indirect impact, related to products and services intended for customers.

Key numbers

Insights

-

BPS climate strategy

-

Net-Zero Banking Alliance

The Net-Zero Banking Alliance represents a path of decarbonization and a long-term vision, to be achieved by 2050. To do this, we have to start acting now.

Net-Zero means cutting greenhouse gas emissions down to zero, achievable through:

- a significant reduction of direct and indirect emissions;

- the balance between remaining or non-reducible emissions produced and emissions removed from the atmosphere.

Net-Zero banking Alliance (NZBA) is a United Nations-led initiative that aims to accelerate the sustainable transition of the global banking sector. It requires participating banks to commit to aligning their lending and investment portfolios to achieve net-zero greenhouse gas emissions by 2050, in line with the targets set by the Paris Agreement on climate change and science-based decarbonization scenarios.

By joining the NZBA, Banca Popolare di Sondrio commits to:

- Aligning lending and investment portfolios to net-zero scenarios by 2050, promoting the transition of their customers;

- Within 18 months, setting targets achievable by 2030 and 2050 for carbon intensive industries;

- Annually reporting progress towards targets and the transition strategy approved by the Board of Directors.

Based on the commitments made to the Alliance, BPS identified priority sectors for which targets should be published taking into consideration the following elements:

- relevance of the sectors to the Bank (i.e., financed emissions);

- availability of data and methodologies for the definition of reduction scenarios and related Net-Zero targets;

- alignment with the coverage of priority sectors on the portfolio published by the Members.

The Bank has identified priority sectors on which it has defined intermediate emission reduction targets to 2030, which have been published 6 months in advance of NZBA's timeline:

- Oil and Gas

- Agriculture

- Iron and Steel

- Aluminium

- Power Generation

-

Target sectors NZBA

The table below summarises the intermediate (to 2030) and long-term (to 2050) targets identified for the Bank's priority areas.

Glossary

Alignment to the Paris Agreement: the Paris Agreement is an international treaty that legally binds its signatories to act to combat climate change. In it, an action plan to limit global warming is outlined which, specifically, stipulates that the global average temperature increase should not exceed 1.5° C by the end of the century.

Financed emissions: financed emissions are defined as the absolute counterpart emissions attributed to the Bank's loans and investments. Such emissions are classified as Scope 3 emissions - Category 15 Investment. It is specified that the PCAF (Partnership for Carbon Accounting Financials) methodology is used to calculate financed emissions, which relates the Bank's gross exposure to counterparties and their absolute emissions.

Reduction target: a percentage reduction level set, in line with the NZBA requirements, at an intermediate (i.e., 2030) and long-term (i.e., to 2050) milestone relative to the base year value identified. The target is defined through the analysis of ‘Net-Zero’ decarbonisation scenarios, aligned with the objectives of the Paris Agreement.

Decarbonisation scenarios: greenhouse gas emission reduction pathways considered for the definition of decarbonisation targets. For the selection of these scenarios, the NZBA guidelines envisage ‘science-based’ approaches aimed at pursuing the goal of limiting global warming to 1-5°C above the pre-industrial average by the end of the century through the use of methodologies from internationally recognised credible sources (e.g. IEA NZE scenarios as defined by the International Energy Agency; Intergovernmental Panel on Climate Change -IPCC- scenarios or additional scenarios derived from such models, including the One Earth Climate Model -OECM- scenarios).

-

Climate and environmental risks

What are C&E risks?

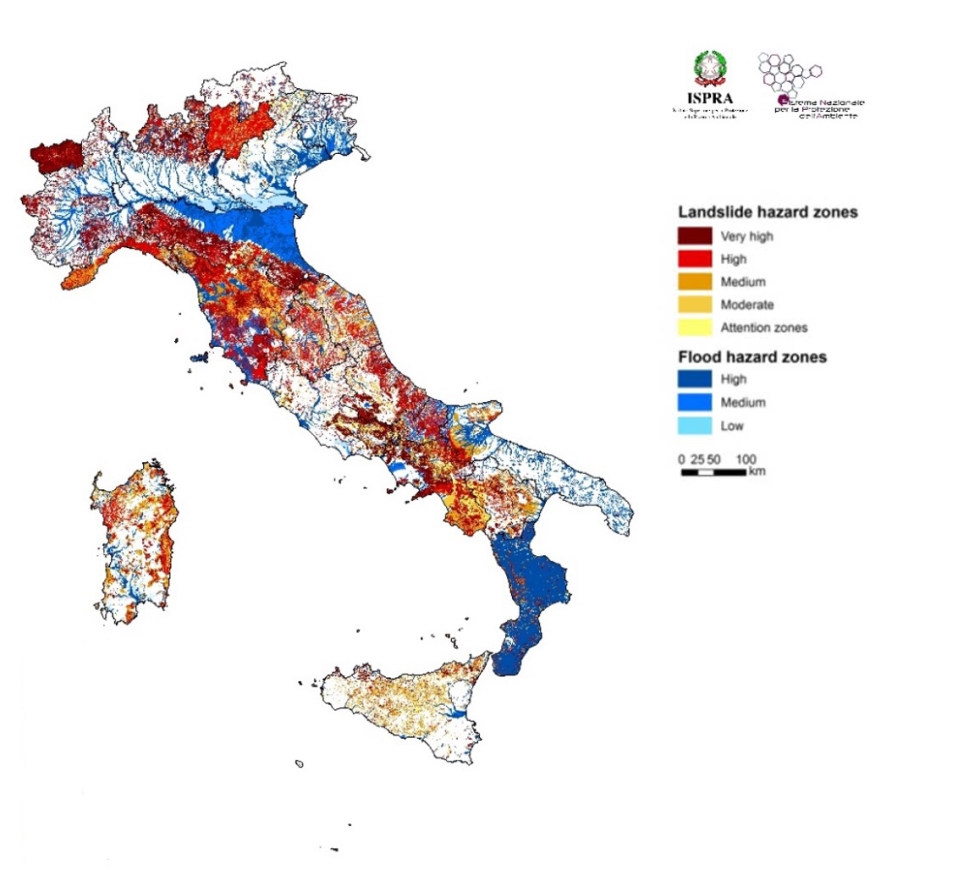

Climate-environmental risks are to be understood as the financial risks generated by the Bank's exposures to counterparties that suffer impacts deriving from climate change and environmental degradation (such as air pollution, water pollution, scarcity of fresh water, soil contamination, biodiversity loss and deforestation), as they are exposed to extreme weather condition or possible changes in their asset value. Managing these risks represents a challenge for the financial sector, stimulated by growing regulatory pressure and by the increasingly widespread occurrence of extreme weather events.

There are two categories of C&E risks: physical and transition risks.Transition risk

Financial loss directly or indirectly related to the transition to a low-carbon and more environmentally sustainable economy.

Physical risk

Financial impact of climate to frequent extreme weather events (‘acute’ physical risk) and to gradual climate changes (‘chronic’ physical risk), as well as environmental degradation, air, water and soil pollution, water stress, loss of biodiversity and deforestation.

Map of Italy with indications of landslide danger and hydraulic danger

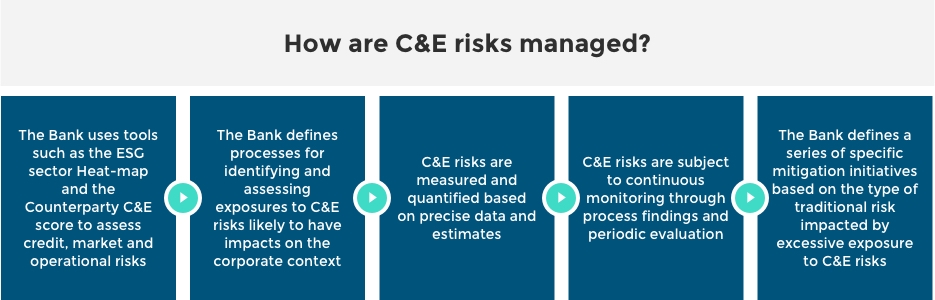

The Bank has adopted a specific “Climate and environmental risks general Regulation " to formalize the governance, management and control of C&E risks.

How are C&E risks managed? 5 steps

- Green Financing

-

Operations

As outlined in 2025-2027 Business Plan «Our way forward», Banca Popolare di Sondrio set the following targets to reduce Scope 1&2 emissions:

- 14% of Scope 1 & 2 emissions reduction by 2030 (7% by 2027);

- 100% of electricity purchased from renewable sources from 2026.

| Attachment | Size |

|---|---|

| Environmental Policy | 1022.93 KB |