Strengthened by our solid founding values, we look to the future with confidence, committing ourselves to carry out our business effectively, in order to support our customers and stakeholders.

These values are also reflected in the Business Plan, which enounce the perspective of a "Bank acting as a Bank", focused on its own distinctive areas, intent on growing and determined to keep high the ambition of a social sustainability.

The enhancement of diversity and inclusion represents a priority for us, for this reason we joined “Valore D”, the first Italian association of large companies committed to promoting an inclusive corporate culture, without discrimination, capable of bringing out everyone's talent through the promotion of diversity.

Furthermore, as evidence of the growing sensitivity towards these issues, we have decided to sign Italian Banking Association Charter "Women in bank", a document supporting signatories in their commitment to equal opportunities.

Key numbers

Policy related to financing the sector of manufacture and trade armaments

The Bank undertakes its commitment to manage exposures to the armaments sector, in full compliance with national and international laws, acting in favour of the “peace economics” as a necessary condition for real sustainable development.

The Group recognizes the pivotal role of the financial sector, in a coherent and transparent manner by encouraging dialogue with its stakeholders.

Specifically, the Policy outlines the principles and guidelines that the Bank follows in its decision-making and operational processes.

Full exclusion of operations with parties involved in the sector of controversial weapons

In order to adopt a differentiated approach, the Policy, which recalls specific internal legislation regarding transactions under Law No. 185/1990 (“New regulations on controlling the exports, imports and transit of military goods”), provides a categorization of the weapons types and activities of the companies operating in the armaments sector, defining the controversial weapons as:

- Anti-personnel mines as defined by Ottawa Treaty (1997) and by Law No. 220/2021;

- Cluster munitions and submunitions as defined by Oslo Convention on Cluster Munitions (2008) and by Law No. 220/2021;

- Nuclear weapons (see the Treaty on the Non-Proliferation of Nuclear Weapons, 1970);

- Biological weapons and Chemical weapons as defined by the Biological and Toxin Weapons Convention (1972) and by the Chemical Weapons Convention (1993), respectively.

The Bank excludes any type of financial exposure towards subjects involved with controversial weapons, including those incurred through subsidiary companies registered in Italy or abroad. Non-exhaustive examples include: lending and financing in any form, issuing of financial guarantees, acquisition of shares, acquisition or underwriting of financial instruments (Art.2, Law no. 220/2021).

In detail, the measures adopted for each financial exposure:

| INVESTMENT: |

Counterparties screening through specialized info providers, regarding:

|

| FINANCING: |

Counterparties screening through IT tool (enhanced due diligence). |

|

TRANSACTIONS: |

|

The Policy identifies specific control systems for all entities operating in the armaments sector, whether involving conventional weapons or residual categories. Additionally, the counterparties in the armaments sector commit to comply with its provisions through a Declaration of Commitment, to be signed upon signing the contractual agreement.

Insights

-

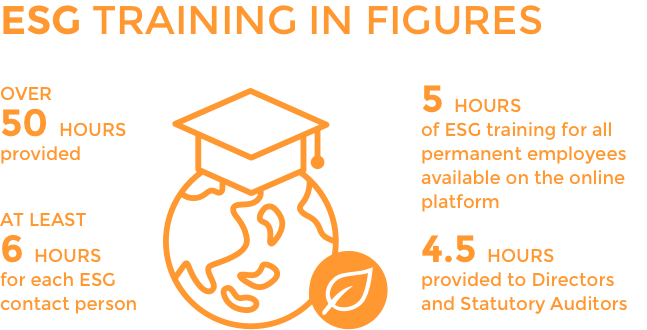

ESG training for employees

-

Support for the internationalization of companies

We offer companies numerous free initiatives which aim to share clear and up-to-date information on the opportunities offered by foreign markets, but also to help Italian companies to explore new business opportunities, in the light of the fact that international markets evolve rapidly, and economic operators must remain constantly updated to be successful.

In total, 15 initiatives were carried out in 2024 with 1,855 participants. Internationalization initiatives are meant not only to disseminate clear and up-to-date information on the opportunities provided by foreign markets, but also to support Italian companies in reaching a wider audience, given the fast-changing nature of international markets and the need, for economic agents, to constantly update in order to succeed.

-

Nonsolobanca

The strong link with the local area and the Community is achieved not only through traditional banking activities, but also through intensive cultural promotion activities.

-

Remuneration policies

Sustainability is a transversal element that affects all areas of operations, reflected in the criteria for measuring the achievement of ESG objectives.

Sustainability-related performance metrics are integrated within the Remuneration Policies, emphasising the link between the Bank's ESG commitment and incentive management. In particular, 10% of the variable remuneration of the General Manager depends on objectives and (or) sustainability-related impacts. -

Financial education for students

In 2024, we renewed our commitment to financial education, collaborating with the FEduF Foundation to involve approximately 400 students from high schools located in the provinces of Sondrio and Como.

The initiative involved two main events: “Let’s Save the Planet”, dedicated to middle school students, introducing the concepts of circular economy, conscious management of resources and sustainable development and “Let’s Invest in the Future”, aimed at high school students, exploring the new paradigms of sustainable finance and civil economy.

Both meetings focused on the themes of the 2030 Agenda for Sustainable Development, offering practical ideas and virtuous models. The activities were conducted by FEduF experts with the support of the Bank’s Sustainability Office, which continues to promote an active dialogue with schools, help educate and train aware and responsible citizens.